Things You Need To Learn About The Different Forms Of PMS Returns In India

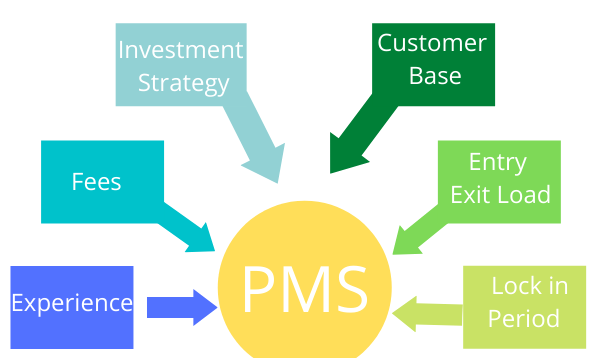

PMS is the pseudo name used for determining Portfolio Management Services are different types of financial services provided to their clients whenever they need any assistance for creating an equity portfolio with the help of skilled and professional portfolio managers and stock market professionals. The main purpose of this service is to provide some advice to excel in equity returns and reduce the risk factor of investments for their clients. In India pms portfolio management services are provided only by the SEBI or the Securities Exchange Board of India. Through this article, the readers and the viewers will learn about how portfolio management services work and how the returns policy is conducted. This service is sometimes referred to as investment for high-net-worth businessmen or industrialists. Investing in PMS returns provides a much clearer concept for investment rather than mutual funds.

Types of portfolio management services-

- Active portfolio management- under this service pattern the main purpose of this service is that the PMS Managers can increase the rate of PMS returns in India. Through this service pattern, the investors invest in different sections such as assets, classes, industries, and businesses.

- Passive portfolio management- through this service, the pms managers suggest that investors invest in index funds that grow slowly within the period. This service results in a high return amount.

Advantages of investing in Portfolio Management Services-

- Customized portfolios- the portfolio managers guide the investors to create their profile and select the trading pattern based on the need and goals to reach depending on the varied sectors, capital investment, theme, etc., and thus through this system the investors get the freedom and right over their portfolio.

- Expert management- this portfolio management service is guided by experienced managers who are well-informed about global and domestic stock markets. They are also responsible to make required adjustments to the portfolio of the client whenever needed.

- Flexibility- the investors have the freedom to choose the different types of services one can choose based on the type of investment done.

- Transparency-

What are the qualifications or eligibility criteria needed for portfolio management services?

- The investor must have a high amount of bank balance that is at a minimum of 50 lakhs.

Why do you need to apply for portfolio management services?

- If you do have little or no knowledge about investment, trading, and share market.

- Individuals who can tolerate high share market risk.

- Should be ready to invest for a long period even though you do not have a stable and regular income but bank account money must be legally liquid.

- Those investors need professional portfolio managers who will let them manage their assets.

How you can invest in PMS?

If you want to invest in PMS or portfolio management services you need to clear out two important documents or agreements signed- the first is your agreement with your portfolio manager or portfolio provider which includes fees depending on different fees for different schedules, filling up of KYC or Know Your Customer, etc. and a POA Power Of Attorney document.

To conclude, the above article reflects on PMS which explains that this service can only be attained by elite-class individuals.